Industry News

TOKYO -- Top Chinese automotive battery maker CATL will provide lithium-ion batteries to Nissan Motor and Renault, accelerating its push to expand business with global carmakers.

CATL, or Contemporary Amperex Technology Ltd., will produce batteries for Nissan's Sylphy Zero Emission electric sedan, scheduled to hit the Chinese market in the latter half of the year. This marks the company's first deal with a Japanese automaker.

The Sylphy -- one of the 20 electrified vehicles Nissan plans to release in China over the next five years -- is slated to become Nissan's first electric vehicle mass-produced there. It is expected to offer a driving range of 338km under the Chinese measurement method.

Electric cars powered with batteries from government-designated manufacturers, which are mostly Chinese producers, will be given priority in receiving subsidies. Nissan decided to procure batteries from CATL as it seeks to balance cost and quality.

The Fujian-based producer is eager to secure more Japanese clients and plans to open a sales and development support hub in Yokohama later this month.

Renault, which is part of a three-way alliance with Nissan and Mitsubishi Motors, has also tapped CATL. The French automaker plans to use CATL batteries for the electric version of its Kangoo compact van under development. CATL already supplies such European automakers as BMW and Volkswagen and hopes to leverage the Renault deal to further solidify its foothold in Europe.

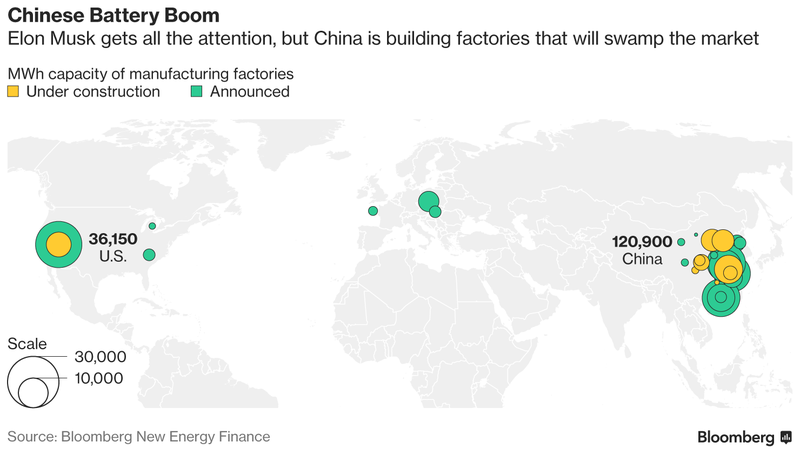

Chinese authorities approved last month CATL's plans to list on the Shenzhen Stock Exchange. The battery maker is expected to procure 13.1 billion yuan ($2.06 billion) from its initial public offering, which could come as early as summer. The funds are expected to be used to boost output capacity, launching mass production plants in the U.S. and Europe as well.

CATL aims to have battery output equivalent to 30 gigawatt-hours by the end of 2019, raising it to the equivalent of 50gwh by 2020 from 23gwh in 2017.

CATL's automotive battery business has soared since the company's 2011 founding, thanks in part to support from the Chinese government. Sales jumped 34% to 19.9 billion yuan for the year ended December, while net profit grew 31% to 3.9 billion yuan. With battery shipments hitting 12gwh in 2017, CATL has grown into a world-class player rivaling Panasonic in the automotive battery business.

Chinese regulations for so-called new-energy vehicles will come into force next year, requiring automakers to produce and sell a certain volume of such vehicles as electrics and plug-in hybrids in the country. Strengthening ties with CATL will likely be essential for carmakers as competition in the world's largest auto market heats up.

...Indian Space Research Organization (ISRO) has offered to sell its lithium-ion technology at a marginal price of Rs 1 crore for use in automobiles. This move should give our country’s automobile industry a big shot in its arm as it will help the companies with the development of locally-produced electric vehicles.

The Vikram Sarabhai Space Centre in Kerala will be seen transferring its lithium-ion cell technology to Indian EV companies on a non-exclusive basis. This will help the companies set up production facilities that can produce cells of varying size, capacity, energy density and power density catering to the entire spectrum of power storage requirements.

Earlier this year, ISRO signed a pact with Bharat Heavy Electricals Limited (BHEL) to transfer the Lithium-ion cell technology that is required to produce batteries for the space agency. This will help ISRO reduce the need to import such batteries to a large extent. The same Lithium-ion technology can also be used in the emerging field of e-mobility. BHEL will soon establish a state-of-the-art facility for the production of cells at its Bengaluru facility.

It’s being said that ISRO has started issuing Request For Qualification (RFQ) at a price of Rs 25,000. Also, the applicants need to make a security deposit of Rs 4,00,00. Once the registrations have been made, candidates will attend a pre-application conference on July 13th. All the queries regarding the RFQ will be attended at this conference. ISRO has said that the “competent firm’s security deposit will be adjusted against the technology transfer fee of Rs 100 lakh. Security deposit of unsuccessful applicants or withdrawn applications will be returned, without any interest”. On being selected, a company must pay the remaining amount within 30 days. “Technology shall be transferred to all/any of the competing firms who qualify the eligibility criteria as specified in the RFQ. The required process documents shall be provided by ISRO at the time of the signing of technology transfer agreement and payment of technology transfer fee.” ISRO added.

News Source – Express Drives

...Triton Solar, New Jersey (US) based storage battery maker, has tied up with Arreda Homes to set up two assembly units one in Andhra Pradesh and the other in Telangana, with a cumulative investment of $300 million (over Rs 2,000 crore), with equal investment going into both the units.

The companies are gearing up to set up their first assembling unit near Guntur in Andhra Pradesh in a 3.5 acre land, where they have built a 41,000 sq ft building. The unit is expected to begin assembling of storage batteries from September this year. Post which, the company will scout for a suitable location in Telangana for their second assembling unit.

Triton founder and CEO Himanshu B Patel said, “We had been making our products for the last five years and exporting to various overseas markets from our US facilities. Our batteries are suited in application areas where power outages are an issue. For instance, in the hospital set up. We offer a clean and green energy alternative to the users. We are also working on developing new batteries that are non-lithium ion based, through our research and development.”

He added, “We are seeing a wide range of applications for our battery products and we will be talking to solar panel makers, residential developers, e-rikshaw manufacturers and hospitals on turnkey basis. We are also developing our own solar panels using nanotechnology and these will be rolled out soon. After setting up units in AP and Telangana, we intend to invest more in India both in terms of manufacturing and marketing.”

Arreda Homes founder NGV Rao told Telangana Today, “We are looking at both power generation and storage in India. We have far advanced printed solar films, which are 40 per cent more efficient than the products currently available in the market. We are keen to set up units for storage batteries in AP and Telangana to cater to the domestic market. We have some own lands in Telangana. Once we obtain industrial permissions, we will begin works on the unit here.”

“Both AP and Telangana units will attract $150 million investment each. Both Triton and Arreda could invest equally into the venture and financial modalities are being worked out. We are evaluating the demand in India at present and may add more facilities in future. India is estimated to have about 2 billion battery market. Automotive industry will be a major consumer for us. We will be catering to clients with both power generation and storage solutions,” he added.

Rao explained, Triton is constantly upgrading its technology and is bringing innovative products in the energy storage space. “With the fresh demand for electric vehicles, we see a huge demand for batteries. We want to provide green and clean energy solutions. We have tested the products in e-rikshaws and are seeing a mileage of 240 km with one full-charge.”

...An agreement on first transfer of technology for lithium-ion batteries was signed here on Sunday between the government-run Central Electro Chemical Research Institute (CECRI) and RAASI Solar Power Pvt Ltd, an official statement said on Sunday.

According to the Science and Technology Ministry statement, this memorandum of understanding is the first of its kind for the country.

The indigenous technology of lithium-ion cells has been developed by a group of scientists at the Council for Scientific Industrial Research (CSIR)'s CECRI in Tamil Nadu's Karaikudi in partnership with CSIR-National Physical Laboratory, CSIR-Central Glass and Ceramic Research Institute, Kolkata and CSIR-Indian Institute of Chemical Technology, Hyderabad, it said.

"CSIR-CECRI has set up a demo facility in Chennai to manufacture prototype lithium-ion cells. It has secured global IPRs with potential to enable cost reduction, coupled with appropriate supply chain and manufacturing technology for mass production," it added.

According to the ministry, Indian manufacturers source lithium-ion batteries from China, Japan and South Korea among some other countries.

"India is one of the largest importers, and in 2017 it imported nearly $150 million worth lithium-ion batteries," it said

"Today's development is a validation of the capabilities of CSIR and its laboratories to meet technology in critical areas to support our industry, besides other sectors," said Science and Technology Minister Harsh Vardhan.

"It will give tremendous boost to two flagship programmes - generating 175 giga watts (GW) by 2022, of which 100 GW will be solar and the second, the National Electric Mobility Mission, to switch completely to electric vehicles by 2030," he added.

Lithium-ion batteries have applications in energy storage systems and can power any electrical application without the need of physical wires.

...Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

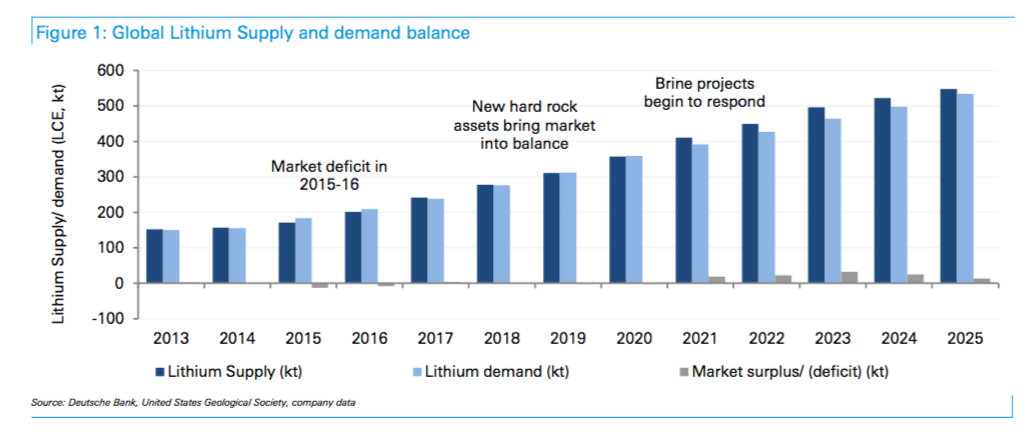

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

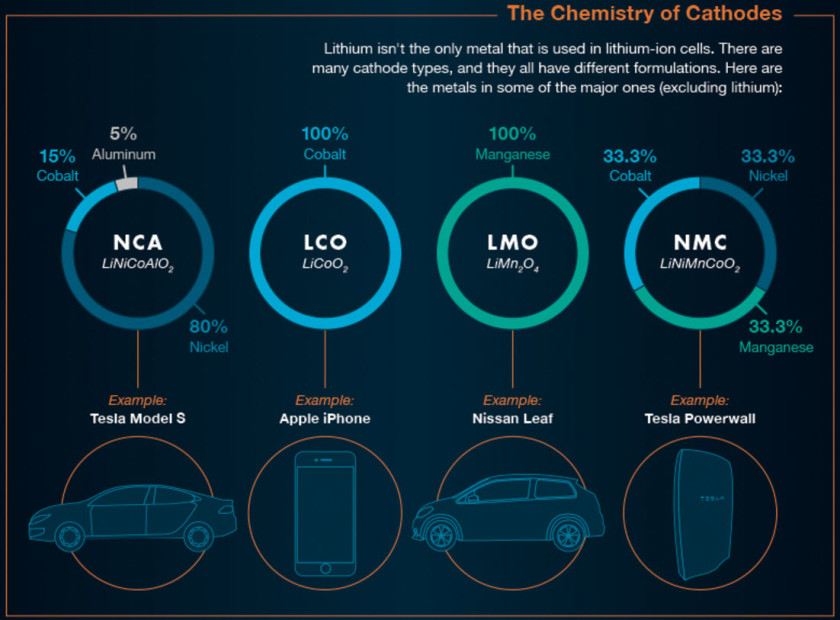

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

...Almost 9,000 miles from the dusty Congo savanna, miners have hit on an entirely new source of cobalt -- the rare mineral at the heart of the electric-car boom. And not only can they take coffee breaks, when they take a break, they can grab a donut at Tim Hortons.

Scientists working for American Manganese Inc., located in the suburbs of Vancouver, have developed a way to produce enough of the bluish-gray metal to power all the electric cars on the road today without drilling into the ground: by recycling faulty batteries.

Cleaner Cars?

It’s one of many technologies that entrepreneurs are patenting to prepare for a time when electric cars outnumber polluting petrol engines, turning the entire automotive supply chain upside down in the process. Instead of radiators, spark plugs and fuel injectors, the industry will need cheap sources of cobalt, copper and lithium.

“Mining batteries is much more profitable than mining the ground,” said Larry Reaugh, the president of American Manganese, which is patenting a method to draw out all of the metals in rechargeable batteries. “Rather than mining ore that’s 2 percent cobalt, you’re mining a battery that has 100 percent cobalt in it.”

Innovators like him have made so much progress that the likes of Tesla Inc. and Toyota Motor Corp. could count on recycling for 10 percent of their battery material needs through 2025 if companies roll out large schemes, according to Bloomberg New Energy Finance. That will ease pressure on lithium and cobalt, whose prices have more than doubled in the past year.

Finding new sources of cobalt, in particular, could be a game-changer because more than half of the relatively rare metal is sourced in the Democratic Republic of Congo. Not only is it one of the world’s poorest countries, doing business there is tough after decades of violence and corruption. Some artisanal mines still use child labor.

American Manganese wants to recycle the one in 10 lithium-ion batteries -- used in everything from home electronics to smart phones -- that fail quality-control tests and end up in hazardous-waste dumps. Doing this could yield as much as 4,000 tons of cobalt, according to Reaugh. If true, that’s equal to the material used in all electric vehicles on the road this year.

Add in the 311,000 metric tons of electric car batteries that Bloomberg New Energy Finance anticipates will stop working by 2025, and the potential trove of metals grows exponentially.

Dissipating Rally

After soaring since 2016, lithium and cobalt gains set to slow

Source: Macquarie Research

Note: Figures show annual percentage change forecasts on price

Recycling could have a “stabilizing effect” on battery metal prices, said George Heppel, a consultant at London-based commodity analysis company CRU Ltd.

After surging from $10 to $30 a pound in less than two years, cobalt’s price gains are poised to slow to $32 by 2021 and $41 by 2022, according to forecasts of Macquarie Group Ltd., one of the largest banks in commodities. Pressure on lithium, sourced mainly from Chilean brine lakes, will also abate as new supply starts getting produced in Argentina and Australia.

“Recycling will help to ease supply constraints that we see coming in the next couple of years,” said James Frith, energy storage analyst at Bloomberg New Energy Finance. “It will be a big deal mainly because you wouldn’t get all the wastage going into the ground.”

That doesn’t mean miners like Glencore Plc, the world’s top producer, will need to scale back production. As the number of electric cars on roads from Shanghai to Paris surges from 2 million now to 118 million vehicles by 2030, demand for cobalt will soar to 156,000 metric tons.

Metals Frenzy

Electric vehicles projected to raise demand for key metals that go into batteries

Source: Bloomberg New Energy Finance

By then, cars that emit less greenhouse gas than combustion engines will be everywhere. The U.K. and France plan to outlaw the sale of petrol- and diesel-powered cars by 2040. China, which is tackling one of the world’s worst air pollution problems, aims for electric cars to make up 10 percent of new sales in two years.

To really live up to their Paris Agreement goals for mitigating global warming, though, governments need to ensure that car batteries -- in some cases weighing more than 500 kilograms -- don’t leave a big environmental footprint when they die. At the moment, some companies burn expired batteries, giving off a range of toxic gases. Others even bury them in the ground.

Umicore’s lithium-ion battery recycling process

Source: Umicore

“We expect recycling will take off in 10 to 12 years when the first wave of electrified vehicles will near end of life,” said Marc Grynberg, the chief executive officer of Brussels-based Umicore, one of the few companies capable of recycling electric-car batteries at an industrial scale at a plant in Belgium.

Umicore has agreements with Tesla and Toyota to recycle their expired batteries in Europe. It uses smelting to recover minerals to make cathode materials -- the part of the battery that houses the chemical reaction and produces the electron.

At American Manganese, Reaugh says he can extract metals at a cost of about 30 cents a pound and resell them to battery manufacturers for up to $20 a pound.

Electric car batteries are harder to recycle than the traditional lead-acid variety because they comprise many materials and manufacturers often have different ways of building them. This could be a hurdle to rolling out standardized recycling schemes, according to Gavin Montgomery, a director of global metals market research at Wood Mackenzie Ltd.

British tech startups Aceleron and Powervault Ltd. are getting around this by transforming dead car batteries into packs that can be used in homes to store renewable energy derived from rooftop solar panels.

“We are not worried about these winding up in landfills,” said Louis Shaffer, renewable energy segment manager of Europe, the Middle East and Africa at Eaton Industries Manufacturing GmbH, which makes batteries. “Today, there aren’t a lot of big recycling centers set up. But like other batteries, once there’s enough out there, it will be a very good business to be in.”

Umicore and American Manganese say they’ve already overcome a major hurdle -- they can now directly recover lithium from batteries, something commercial smelting hasn’t always been able to do.

Reaugh, who spent four decades working for miners of precious and base metals in the Americas and China, is patenting a technique that removes the battery casing with robotics and soaks the cell in a chemical solution for 30 minutes to bring out the pure metals. He plans to raise $6 million next year to build a pilot plant near Vancouver.

“This is an immediate market,” he said.

— With assistance by Mark Burton

...Governor Andrew M. Cuomo today announced Imperium3 New York, Inc., a consortium of businesses spearheaded by three Southern Tier companies, will establish research and development and production operations at the Huron Campus in Endicott, Broome County. The consortium will invest more than $130 million and create at least 230 new jobs over the next five years. Imperium3 New York will commercialize an innovative technology for making more efficient and less expensive lithium ion batteries while operating the state's first giga-factory producing lithium ion batteries, producing three gigawatts of batteries by Q4 2019 and growing to fifteen gigawatts.

"This consortium of local businesses is choosing to stay and invest their next generation technology right here in the Southern Tier, breathing new life into vacant facilities and creating hundreds of good jobs for New Yorkers," Governor Cuomo said. "Our investments to improve the business climate and spur economic development across Upstate New York are paying off, and this innovative project is yet another example of how the Southern Tier is soaring."

The Imperium3NY consortium was formed by nearly 10 companies, with three Southern Tier companies serving as its backbone:

- C4V (Binghamton) will provide the core intellectual property

- C&D Assembly (Groton) is supplying electronic board assembly and battery testing

- Primet Precision Materials (Ithaca) is offering advanced processing of materials

Other New York State companies involved include Kodak and CMP Advanced Mechanical Solutions. The general market for lithium-ion batteries continues to grow daily and serves multiple industries, including renewable energy projects, electric vehicle manufacturers, cell phone and other electronic product makers, among many others. Industry experts consider C4V's batteries to be more efficient and less costly than other lithium-ion batteries on the market today.

Imperium3NYwill locate operations at the Huron Campus in Endicott, establishing a new $130 million lithium-ion battery production giga-plant and hiring 232 employees, ultimately ramping to 15 giga-watts of production and hundreds more jobs. To encourage this collaborative effort, Empire State Development has offered performance-based incentives totaling $7.5 million, including a $4 million Upstate Revitalization Initiative grant and $3.5 million in Excelsior Jobs Program tax credits. Additionally, Imperium3NY is expected to qualify for an estimated $5.75 million in New York Investment Tax Credits.

In 2016, C4V was recognized for its innovative battery storage technology when it was named a $500,000 winner in New York State's first 76West Clean Energy Competition. Administered by the New York State Energy Research and Development Authority, 76West is one of the largest competitions in the country that focuses on supporting and growing clean-energy businesses and expanding innovative entrepreneurship in the Southern Tier.

Additionally, Magnis Resources, Ltd., a publicly-traded Australian company, will provide anode materials needed for the consortium to make the innovative lithium-ion batteries; and Boston Energy and Innovation, another Australian business specializing in clean energy, will provide international sales and marketing opportunities. More than twenty international companies have been qualified by C4V as strategic suppliers of high-quality lithium, electrolyte, separator and other critical raw ingredients to Imperium3NY that includes a Lithium mine just hours from Binghamton.

Dr. Shailesh Upreti, President of C4V, said, "We are excited by the support shown to our consortium by the New York State Government. Green manufacturing in combination with the best utilization of an existing infrastructure in a distributed fashion would create an unmatched example internationally and make New York a global leader in product and component manufacturing for energy storage. C4V is very excited to be part of this scale up initiative and is fully committed to make this happen right here in New York."

Jeff Cronk, CEO of C&D Assembly, said, "My company has always been about the local content, local skill and all markets. We have been supplying electronics parts, components and end products to global market for last 25 years and actively looking for new projects that govern the future of the human race. C&D's current manufacturing floor is capable of handling battery management system production for up to 20GWh annually assuming each battery is 80kWH in size. Our knowledge base and deep understating of product quality control would give the New York consortium a significant edge in the market and I am very excited to be part of this consortium."

Robert Dobbs, President of Primet Precision Materials, said, "Performance of a battery lies in the material composition and particle features. A good control over particle shape and size is key to extract best performance out of a molecule. Primet has developed and demonstrated its powder technology on tonne scale with various materials used in Li-ion batteries. Our demonstrated ability to reduce the capital investment as well as operational expenses would allow this consortium to build batteries that are not only high performing but also very economical versus batteries from Asia."

Empire State Development President, CEO and Commissioner Howard Zemsky said, "The Southern Tier is becoming a hub for research, innovation and advanced manufacturing, and Imperium3NY's decision to establish a giga-factory in Endicott is yet another indicator of the region's bright future. This project will create hundreds of jobs and we are thrilled to see a concept that was developed here, will be commercialized right here in Upstate New York."

Alicia Barton, President and CEO, NYSERDA said, "This new consortium is a tremendous step forward in helping New York meet Governor Cuomo's aggressive clean energy goals by supporting both this emerging industry and new start-up companies. One of the reasons the 76West Clean Energy Competition exists is to enable companies to grow their businesses and create jobs in the Southern Tier, and we are thrilled that C4V has a central role in this project and in the Southern Tier's clean energy ecosystem."

Southern Tier Regional Economic Development Council Co-Chairs Tom Tranter, President & CEO of Corning Enterprises and Harvey Stenger, President of Binghamton University, said, "The STREDC is proud to reinforce our commitment to innovation through projects such as the Imperium3 consortium. This effort will work to provide the needed resources, researchers, and entrepreneurs who are working to advance the battery industry. Under Governor Cuomo's leadership, New York State is establishing itself as a world leader when it comes to this burgeoning industry.

This announcement also builds on the significant work being done in New York State in the energy storage and advanced battery industries. Earlier this year NYSERDA made almost $22 million available in two separate solicitations for energy storage projects as part of New York State's long-term investment in the energy storage sector. In 2010 the New York Battery and Energy Storage Technology (NY-BEST) Consortium was created with seed funding from NYSERDA to position New York State as a global leader in energy storage technology, including applications in transportation, grid storage, and power electronics. NY-BEST's membership - most of which are New York State based entities - is diverse and includes manufacturers, academic institutions, utilities, technology and materials developers, start-ups, government entities, engineering firms, systems integrators, and end-users. NY-BEST serves as an important connector in establishing a strong energy storage "ecosystem" encompassing all stages of energy storage product development and use.

A report issued by NYSERDA in January found that jobs in the State's energy storage sector grew to approximately 3,900 - a 30 percent increase from 2012 through 2015. New York's commitment to clean energy has helped spur the strong growth, which also saw annual industry revenues reach an estimated $906 million during the same time period, a 50 percent increase.

Dr. William Acker, Executive Director of the New York Battery and Energy Storage Technology (NY-BEST) Consortium said,"The battery and energy storage industry is growing rapidly and the race is on to capture the high-volume, high-growth, advanced battery market and the jobs that come with it. Governor Cuomo's support and leadership has helped New York State establish itself as a leader in clean energy and, as today's announcement demonstrates, this is the ideal place to develop, commercialize and manufacture new battery and energy storage technologies."

Senator Tom O'Mara, Chair of the Senate Environmental Conservation Committee, said, "New York State continues to play a leading role in the research and development of advanced, cutting-edge, and innovative energy technologies. We appreciate Governor Cuomo's recognition that the Southern Tier region is well positioned to keep moving the state forward in this arena. These ongoing investments hold out the promise for exciting economic opportunities and job growth for the entire region."

Senator Fred Akshar said, "The Huron Campus in Endicott is the perfect location to continue our community's legacy of innovation and technology for decades to come. I applaud the hard work of the Southern Tier companies and their partners, Empire State Development and Governor Cuomo for putting the pieces together to make this a reality for the people of the Southern Tier."

Assemblymember Donna Lupardo said, "The Southern Tier has a strong history of attracting new ideas and the businesses and jobs that come with them. With the Governor and the Legislature working together, Upstate New York is attracting innovative businesses like Imperium. I'd like to thank the Governor for his continued commitment to these project that are helping to transform our local economy."

Broome County Executive Jason Garnar said, "Under Governor Cuomo's leadership, the Southern Tier's economy is soaring like never before, thanks to smart investments in local strengths and emerging industries. Imperium's decision to stay and invest here is proof positive that the Governor's economic development strategy is paying off and delivering real results for New Yorkers."

Accelerating Southern Tier Soaring

Today's announcement complements "Southern Tier Soaring the region's comprehensive blueprint to generate robust economic growth and community development. The State has already invested more than $3.1 billion in the region since 2012 to lay for groundwork for the plan - attracting a talented workforce, growing business and driving innovation. Today, unemployment is down to the lowest levels since before the Great Recession; personal and corporate income taxes are down; and businesses are choosing places like Binghamton, Johnson City and Corning as a destination in which to grow and invest. Now, the region is accelerating Southern Tier Soaring with a $500 million State investment through the Upstate Revitalization Initiative, announced by Governor Cuomo in December 2015. The State's $500 million investment will incentivize private business to invest well over $2.5 billion - and the region's plan, as submitted, projects up to 10,200 new jobs.

Source: www.governor.ny.gov

...Magnis Resources Ltd (ASX:MNS) has received support and a funding package for the stage 1 production at New York State’s first lithium-ion gigafactory to be located at Huron Campus in upstate New York.

The gigafactory is to be built by a consortium of companies including Magnis, Charge CCCV (C4V), Boston Energy and Innovation, C&D Assembly and Primet Precision Materials.

A joint manufacturing establishment agreement was signed in May 2017 for a 15 GWh (gigawatt hours) lithium-ion battery plant.

The recent finalisation of the scoping study priced the capital costs for Stage 1 at US$130 million with an expected first production date in the second half of 2019.

The first stage production will be at 3 GWh with a ramp up to 15 GWh.

Importantly, offtake discussions are nearing completion with a high demand coming from global groups including stationary storage and vehicle manufacturers.

The exact details of the funding package will be released by the New York State Government in the near future.

The securities of Magnis will remain in voluntary suspension until such time the information is made available to the market.

Magnis’ Townsville lithium-ion gigafactory is also making progress, with Queensland Premier Annastacia Palaszczuk recently publicly expressing her support for the project.

The Townsville lithium-ion gigafactory is to be built by a consortium of companies led by Boston Energy & Innovation along with Magnis, Charge CCCV and C&D Assembly.

...University of Central Florida Assistant Professor Yang Yang's research group has developed two promising energy storage technologies in its work with sustainable energy systems.

Yang sees revolutionary systems that can produce and store energy inexpensively and efficiently as a potential solution to energy and environmental crises.

"We try to convert solar energy either to electricity or chemical fuels. We also try to convert chemical fuels to electricity. So, we do different things, but all of them are related to energy," said Yang, who came to UCF in 2015 and has joint appointments in the NanoScience Technology Center and the Department of Materials Science and Engineering.

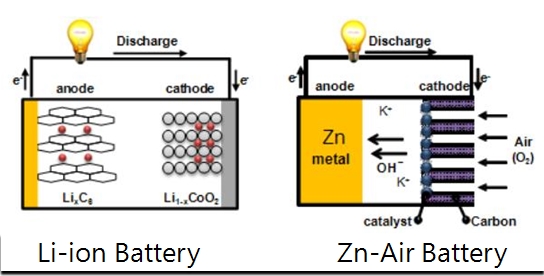

One of the researchers' technologies would upgrade the lithium-based batteries that are ubiquitous in today's laptops, smartphones, portable electronics and electric vehicles. The other offers a safer, more stable alternative than lithium batteries.

Electrode For High-Performance Battery

As recently reported in the scholarly journal Advanced Energy Materials, the UCF researchers designed a new type of electrode that displays excellent conductivity, is stable at high temperatures and cheap to manufacture. Most significantly, it enables a high-performance lithium battery to be recharged thousands of times without degrading.

Batteries generate electrical current when ions pass from the negative terminal, or anode, to the positive terminal, or cathode, through an electrolyte.

Yang's group developed a battery cathode created from a thin-film alloy of nickel sulfide and iron sulfide. That combination of materials brings big advantages to their new electrode.

On their own, nickel sulfide and iron sulfide each display good conductivity. Conductivity is even better when they're combined, researchers found.

They were able to boost conductivity even more by making the cathode from a thin film of nickel sulfide-iron sulfide, then etching it to create a porous surface of microscopic nanostructures. These nanopores, or holey structures, greatly expand the surface area available for chemical reaction.

"This is really transformative thin-film technology," Yang said.

All batteries eventually begin degrading after they've been drained and recharged over and over again. Quality lithium-based batteries can be drained and recharged about 300 to 500 times before they begin to lose capacity. Tests show a battery with the nickel sulfide-iron sulfide cathode could be depleted and recharged more than 5,000 times before degrading.

Researchers Kun Liang and Kyle Marcus from Yang's group worked on the project. Collaborators included Le Zhou, Yilun Li, Samuel T. De Oliveira, Nina Orlovskaya and Yong-Ho Sohn, all of UCF, and Shoufeng Zhang of Jilin University in China, and Yilun Li of Rice University.

New Catalyst for Better Energy Storage

Graduate student researchers in Yang's lab also developed a new catalyst for a high-efficiency battery that has several advantages over conventional ones.

Metal-air batteries, fuel cells and other energy storage and conversion applications rely on chemical reactions to produce current. In turn, those reactions need an efficient catalyst to help them along. Precious metals including platinum, palladium and iridium have proven to be efficient catalysts, but their high cost and poor stability and durability make them impractical for large-scale commercialization.

Researchers in Yang's group led by Wenhan Niu, Zhao Li and Kyle Marcus developed a new process for creating a catalyst with a substrate of graphene, a highly conductive two-dimensional material with the thickness of a single atom.

As reported last week in Advanced Energy Materials, they showed the effectiveness of their catalyst's nanomesh-like structure by testing it in a zinc-air battery, demonstrating its capability of being depleted and recharged many times.

The electrocatalyst is safer and more stable than the volatile compounds found in lithium batteries, and can function in rain, extreme temperatures and other harsh conditions. And without the need for precious metals, it can be manufactured more cheaply.

Story Source:

Materials provided by University of Central Florida.

...what will be the biggest private investment in a new industry in recent years, India’s leading business groups are readying plans to enter battery manufacturing and battery pack assembly with investments running into several billion dollars over the next decade or so.

Reliance Industries, the country’s largest company by revenues, seems to be most ambitious of the lot. Multiple sources said the company had aggressive plans with one telling FactorDaily that it was looking at a factory that would produce Lithium-Ion (Li-Ion) batteries of 25 gigawatt-hours (GWh) capacity. A second source said that the Reliance factory would be in either Gujarat or Maharashtra.

“There is a lot happening in the EV space, and Reliance has long been in the energy business. Add to that, it now is a maker of phone and has telecom towers – all of them powered by Li-Ion battery,” said the second source, who is close to Reliance, asking not to be identified. A factory even at half the 25 GWh capacity “will be huge for India,” he added.

A 25 GWh factory will cost at least $3.5 billion, benchmarked against spending on global projects of similar scale. A request for comment sent to Reliance didn’t elicit a response.

Reliance already has a partnership with British oil and gas company BP for energy storage projects near solar and wind energy installations in India.

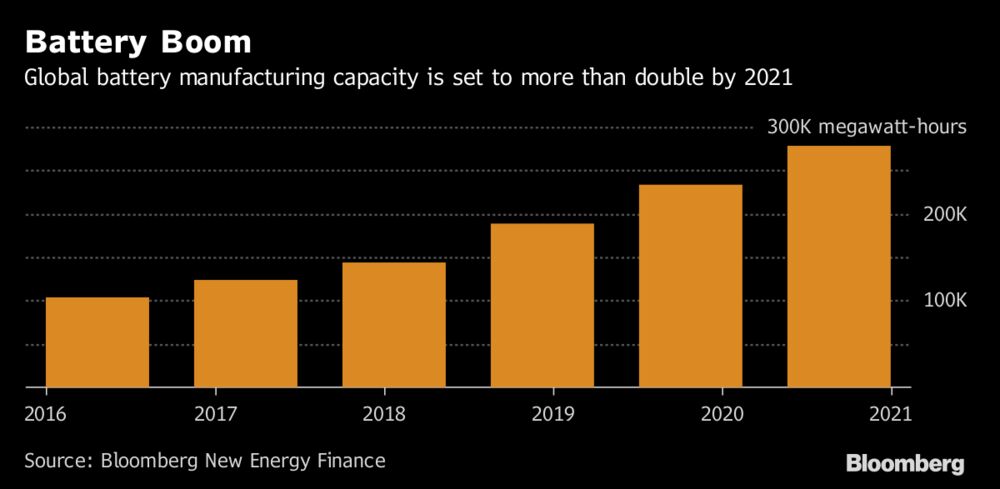

The global production of Li-Ion batteries stands at over 100 GWh today and is expected to climb to 273 GWh by 2021, according to data from Bloomberg. Electric vehicle (EV) maker Tesla has the biggest factory that will produce 35 GWh annually when its so-called Gigafactory is fully built out in 2018 in Nevada, US. Most of the remaining capacity is coming up in China, with India not even a blip on the global batteries production map in most projections.

China is predicted to increase its dominance in Li-Ion battery manufacturing in the years ahead

The Li-Ion bandwagon

The Adani, the JSW, the Mahindra and the Hero groups of companies are in the race to set up Li-ion battery production in India.

“Not only Reliance, others like JSW, Adani, and Mahindra are also looking at the battery pack business,” said a third source who has been in the EV industry for more than a decade now.

With the EV race in India starting — India has ambitions of being an all electric car nation by 2030 — international players such as Suzuki Motor Corp. and Toshiba Corp. have already unveiled their Li-Ion battery plans for India. Last week, Suzuki announced that it will invest Rs 1,150 crore together with Japanese partners Toshiba and Denso Corp. to set up a Li-Ion battery facility in Gujarat. Suzuki will own 50%, Toshiba 40%, and Denso 10% of the joint venture that will make batteries and battery packs for Indian car maker Maruti Suzuki and export to Suzuki.

Mumbai-based JSW Energy, part of Sajjan Jindal-led JSW Group, which wants to launch EVs by 2020, is also planning to set up a battery factory. The energy storage opportunity for India extends beyond electric vehicles into telecom, micro grids, and solar storage for household and power banks, JSW Energy said in a statement in response to a FactorDaily query. “JSW Energy plans to enter into energy storage systems business for both in static and mobility applications as it will be forward integration of its existing business of power generation to distribution.”.

Hero Future Energies said it was awaiting a government policy before taking the plunge. “We are looking at energy storage and lithium ion battery packs manufacturing. That’s is a big opportunity, both in vehicles and utility, but we haven’t taken up a firm decision yet, on which direction we should take as there is no policy around it,” CEO Sunil Jain said on email. “It’s an expensive business to be in and we are waiting for the government to bring out some policy and some incentives.”

Requests for comments sent to the Adani and Mahindra groups were not answered.

Exicom, a telecom infrastructure provider that is part of the HFCL group, which has been in the Li-Ion battery business since 2013, is increasing its manufacturing capacity to 1 GWh. “We already have more than 500 megawatt of deployment, mostly in telecom towers for backup application,” said Anant Nahata, managing director of Exicom. “We have been importing the cells and making battery packs in our factory in Gurugram. The demand is slowly opening up – in the EV sector, for home use, for grid scale ESS, among others – especially after the price has come down in the past 24 months. We are expanding our capacity to 1 gigawatt now.”

Mobile towers, ATMs

The rush into Li-Ion battery production is part of a reset that India is attempting in its energy industry. India wants to reduce its oil dependency (it imports more than 80% of its crude currently) and move to a future that uses solar energy to power itself. It has an ambition to increase solar generated power to 100 gigawatt (GW) by 2022 from the current 13.65 GW.

But, this is only one part of the push. By 2030, the central government wants only electric cars to be sold in India. As early as the turn of this year, London consultancy IHS Markit predicts that India will overtake Germany to become the world’s fourth-largest car market by volumes; and the third-largest by 2020.

In its National Electric Mobility Mission Plan, the government targets six to seven million EVs on Indian roads by 2020. That target is likely to be missedbut to power EVs, the country will need Li-Ion batteries and battery packs. Currently, the battery pack costs nearly half an EV’s cost in India. Any effort to reduce that cost – via local production, for instance – will add to the shift towards a lower petroleum footprint in the economy.

A mobile tower and its backup power system atop a building in Kerala

The impact of this push is not just on EVs. With power outages common in India, mobile towers operated by telecom service providers and ATM networks are already among the largest users of Li-ion batteries.