what will be the biggest private investment in a new industry in recent years, India’s leading business groups are readying plans to enter battery manufacturing and battery pack assembly with investments running into several billion dollars over the next decade or so.

Reliance Industries, the country’s largest company by revenues, seems to be most ambitious of the lot. Multiple sources said the company had aggressive plans with one telling FactorDaily that it was looking at a factory that would produce Lithium-Ion (Li-Ion) batteries of 25 gigawatt-hours (GWh) capacity. A second source said that the Reliance factory would be in either Gujarat or Maharashtra.

“There is a lot happening in the EV space, and Reliance has long been in the energy business. Add to that, it now is a maker of phone and has telecom towers – all of them powered by Li-Ion battery,” said the second source, who is close to Reliance, asking not to be identified. A factory even at half the 25 GWh capacity “will be huge for India,” he added.

A 25 GWh factory will cost at least $3.5 billion, benchmarked against spending on global projects of similar scale. A request for comment sent to Reliance didn’t elicit a response.

Reliance already has a partnership with British oil and gas company BP for energy storage projects near solar and wind energy installations in India.

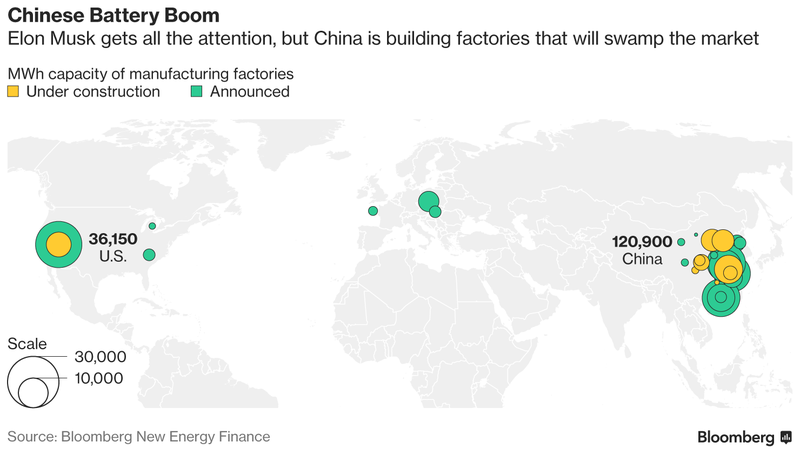

The global production of Li-Ion batteries stands at over 100 GWh today and is expected to climb to 273 GWh by 2021, according to data from Bloomberg. Electric vehicle (EV) maker Tesla has the biggest factory that will produce 35 GWh annually when its so-called Gigafactory is fully built out in 2018 in Nevada, US. Most of the remaining capacity is coming up in China, with India not even a blip on the global batteries production map in most projections.

China is predicted to increase its dominance in Li-Ion battery manufacturing in the years ahead

The Li-Ion bandwagon

The Adani, the JSW, the Mahindra and the Hero groups of companies are in the race to set up Li-ion battery production in India.

“Not only Reliance, others like JSW, Adani, and Mahindra are also looking at the battery pack business,” said a third source who has been in the EV industry for more than a decade now.

With the EV race in India starting — India has ambitions of being an all electric car nation by 2030 — international players such as Suzuki Motor Corp. and Toshiba Corp. have already unveiled their Li-Ion battery plans for India. Last week, Suzuki announced that it will invest Rs 1,150 crore together with Japanese partners Toshiba and Denso Corp. to set up a Li-Ion battery facility in Gujarat. Suzuki will own 50%, Toshiba 40%, and Denso 10% of the joint venture that will make batteries and battery packs for Indian car maker Maruti Suzuki and export to Suzuki.

Mumbai-based JSW Energy, part of Sajjan Jindal-led JSW Group, which wants to launch EVs by 2020, is also planning to set up a battery factory. The energy storage opportunity for India extends beyond electric vehicles into telecom, micro grids, and solar storage for household and power banks, JSW Energy said in a statement in response to a FactorDaily query. “JSW Energy plans to enter into energy storage systems business for both in static and mobility applications as it will be forward integration of its existing business of power generation to distribution.”.

Hero Future Energies said it was awaiting a government policy before taking the plunge. “We are looking at energy storage and lithium ion battery packs manufacturing. That’s is a big opportunity, both in vehicles and utility, but we haven’t taken up a firm decision yet, on which direction we should take as there is no policy around it,” CEO Sunil Jain said on email. “It’s an expensive business to be in and we are waiting for the government to bring out some policy and some incentives.”

Requests for comments sent to the Adani and Mahindra groups were not answered.

Exicom, a telecom infrastructure provider that is part of the HFCL group, which has been in the Li-Ion battery business since 2013, is increasing its manufacturing capacity to 1 GWh. “We already have more than 500 megawatt of deployment, mostly in telecom towers for backup application,” said Anant Nahata, managing director of Exicom. “We have been importing the cells and making battery packs in our factory in Gurugram. The demand is slowly opening up – in the EV sector, for home use, for grid scale ESS, among others – especially after the price has come down in the past 24 months. We are expanding our capacity to 1 gigawatt now.”

Mobile towers, ATMs

The rush into Li-Ion battery production is part of a reset that India is attempting in its energy industry. India wants to reduce its oil dependency (it imports more than 80% of its crude currently) and move to a future that uses solar energy to power itself. It has an ambition to increase solar generated power to 100 gigawatt (GW) by 2022 from the current 13.65 GW.

But, this is only one part of the push. By 2030, the central government wants only electric cars to be sold in India. As early as the turn of this year, London consultancy IHS Markit predicts that India will overtake Germany to become the world’s fourth-largest car market by volumes; and the third-largest by 2020.

In its National Electric Mobility Mission Plan, the government targets six to seven million EVs on Indian roads by 2020. That target is likely to be missedbut to power EVs, the country will need Li-Ion batteries and battery packs. Currently, the battery pack costs nearly half an EV’s cost in India. Any effort to reduce that cost – via local production, for instance – will add to the shift towards a lower petroleum footprint in the economy.

A mobile tower and its backup power system atop a building in Kerala

The impact of this push is not just on EVs. With power outages common in India, mobile towers operated by telecom service providers and ATM networks are already among the largest users of Li-ion batteries.

“The largest consumer for Li-Ion batteries is telecom towers. Reliance Jio is already importing batteries for its telecom towers. The diesel gensets used in the rural telecom towers are now being replaced with Li-Ion batteries,” said Debi Prasad Dash, Director of industry body India Energy Storage Alliance (IESA). “Similarly the Lead-acid batteries used for telecom towers in tier-1 and tier-2 cities are also being replaced with Li-Ion batteries.”

Mobile towers, the second largest consumer of diesel (used to power generators) after the Indian Railways, are under pressure to move to less environmentally-harsh sources of energy. The Indian telecom regulator has recommended mobile operators to convert all rural mobile towers and 50% of urban mobile towers to be hybrid powered by 2020.

Reliance Jio, the mobile phone service owned by Reliance Industries, has been procuring Li-ion batteries produced by Paris-based company SAFT for powering its mobile towers. In 2015, Reliance Jio had placed an additional order for Li-Ion batteries, from the Evolion series manufactured by SAFT, worth over €20 million.

Virtuous Li-Ion prices

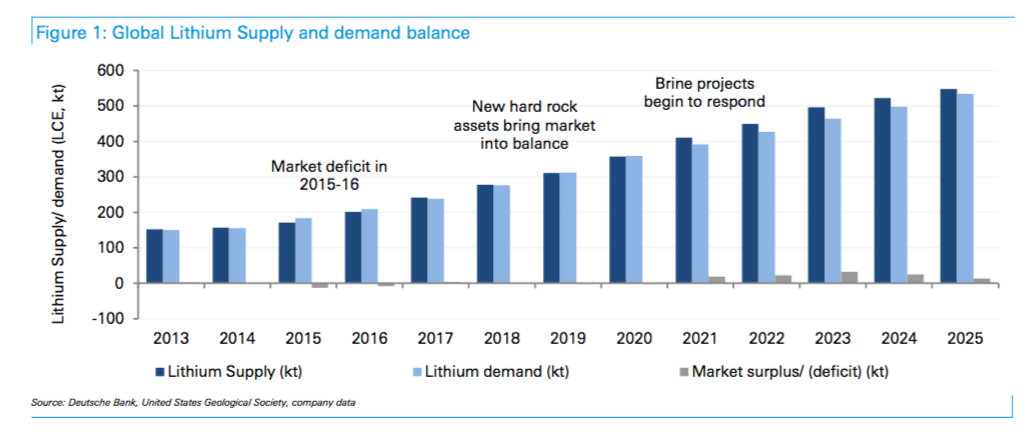

The prices of Li-Ion cells are also falling, increasingly making the solar energy-battery storage combination to power energy needs a reality.

Back in 2011, Li-ion batteries cost around $600 per KWh to produce but with improvements in battery technology, this cost has substantially come down. Today, batteries around $200 per KWh. Tesla claims that the Tesla Model 3 battery comes at a cost below the $190 per KWh mark.

While the Model 3 is yet to hit Indian shores, Tesla founder Elon Musk was said to being wooed by the government to set up a manufacturing unit for its EVs in India. Musk had even tweeted that a Gigafactory in India would make sense in the long run.

Currently, Indian companies are importing Li-Ion cells from China and making battery packs in India. Setting up a cell manufacturing unit is an expensive proposition as compared to importing cells and manufacturing packs.

IESA’s Dash also said public sector units are eyeing energy storage and Li-Ion cell manufacturing in India.

The Indian Space Research Organisation (ISRO) had developed a Li-Ion battery technology for use in its satellites and launch vehicles such as GSLV and PSLV. ISRO is teaming up with heavy electric equipment maker BHEL to help develop low-cost Li-Ion batteries.

Source: FactorDaily

China's CATL to supply car batteries to Nissan and Renault