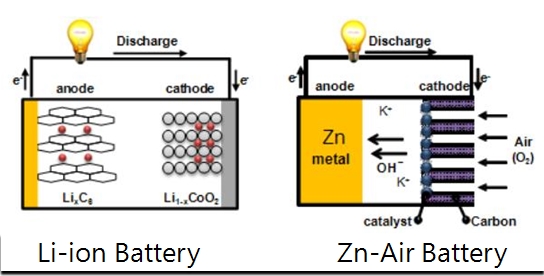

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

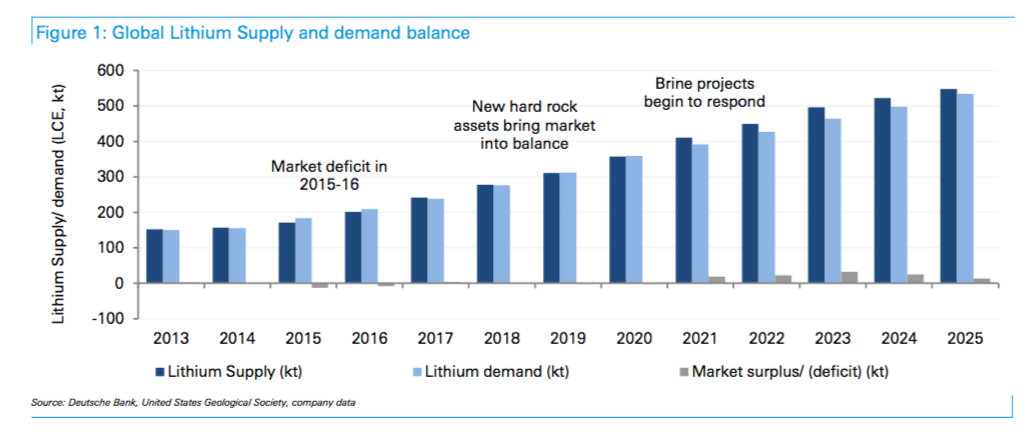

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

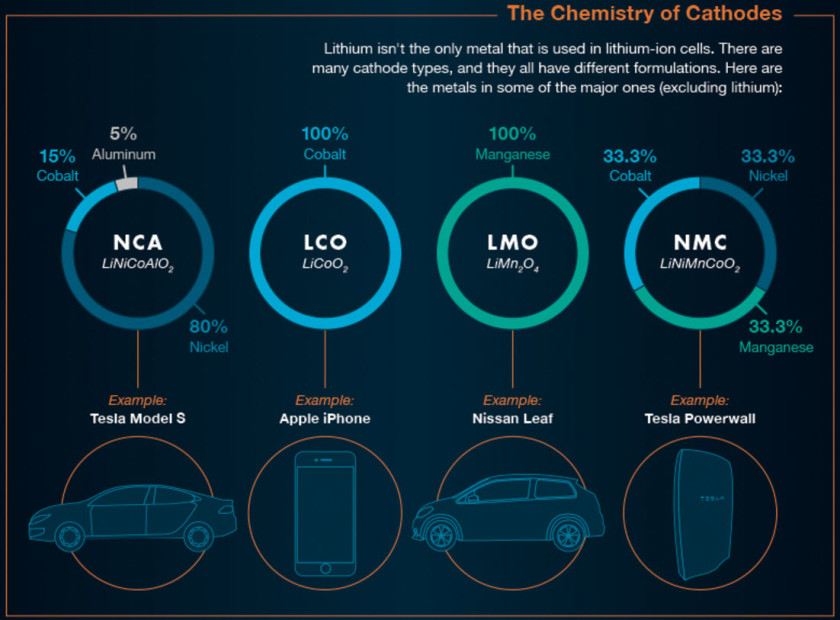

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

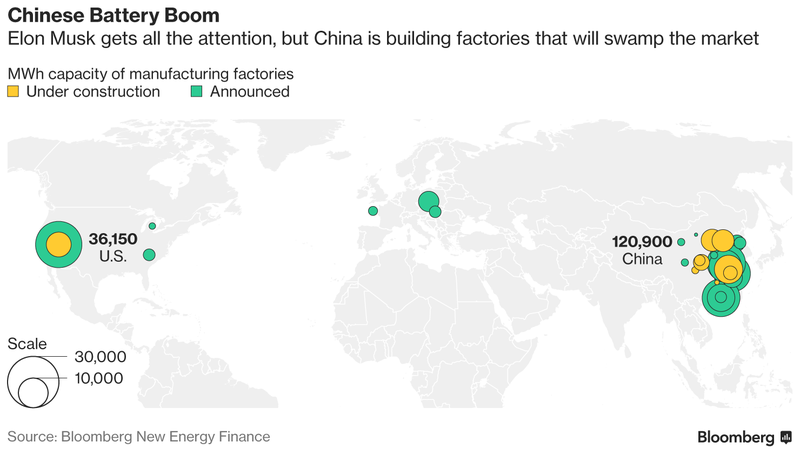

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

Less than 1 percent of cars worldwide run electric, but they're increasingly gobbling up Earth's lithium-ion battery supply. Almost half of these batteries are used in the automotive industry, according to a new a analysis published Wednesday in Joule, the sister journal to Cell that addresses sustainable energy. The study argues that the world needs to start preparing for an influx of demand for these batteries, which are used in smartphones, electric cars, and off-grid systems, like Tesla's Powerwall.

ADVERTISEMENT

"Even before [the lithium-ion battery industry] went into these large sectors like automotive and grid it was growing at like a 20 percent growth rate," Gerbrand Ceder, one of the study's authors and a professor of materials science & engineering at the University of California, Berkeley told me over the phone. "Now that we're seeing it be introduced in automotive it's growing even faster."

Lithium-ion battery consumption has grown 73 percent from 2010 to 2014, whereas production has only increased 28 percent, according to the study.

In short, the researchers estimated that over the next 15 years, there will likely be enough raw materials available to meet lithium-ion battery demand. But if we don't work out supply chain issues, production could slow down—essentially delaying some of the world's most promising alternative energy technologies.

The study's authors used publicly available data to try and predict how much of the metals used in lithium-ion batteries would be needed to accommodate future demand for things like electric cars. Aside from the element in their name, lithium-ion batteries also also composed of other elements, including manganese, nickel, graphite, and cobalt.

The researchers found that cobalt—which is also used in iPhones—was most vulnerable to potential supply chain issues. Most of the world's cobalt is found in the Democratic Republic of Congo, and is often mined under torturous labor conditions. In 2016, the Washington Post found miners, including children, worked around the clock using hand tools to extract the mineral.

A lithium factory in Chile. Image: Jason Koebler

If cobalt supply does becomes an issue, which the study's authors say could be the case by 2025, it might be possible to produce lithium-ion batteries using other metals, like manganese, molybdenum, chromium, or titanium.

Lithium was deemed to be less vulnerable to supply shortages because it can be mined in different ways, and is found in numerous countries, like Australia and Chile. One of the world's largest supplies of lithium is in Bolivia, in Earth's largest salt flat, Salar de Uyuni, and remains almost entirely untapped (though the government is now testing mining methods there).

ADVERTISEMENT

Worldwide, lithium is not a major business—total sales are only roughly $1 billion a year. But as battery-powered technologies become even more central to our lives, the element is growing in demand. The investment bank Goldman Sachs called it "the new gasoline."

One thing the analysis didn't take into account are the effects of events like hurricanes, which could disrupt battery supply in the future.

Battery manufacturing is ramping up in part because of Tesla, which recently opened the Gigafactory—the world's largest battery factory—in Nevada. Its expected to produce batteries for 500,000 cars each year, starting in four years.

Outside the Tesla Gigafactory. Image: Jason Koebler

"The basic math was that in order to make half million cars a year, we need every lithium-ion battery factory on earth that makes batteries for phones, laptops, cars, everything, just to achieve that output," Tesla CEO Elon Musk said at the opening of the Gigafactory.

Musk has talked about building additional Gigafactories in the US and abroad, and has repeatedly said that the company would attempt to recycle batteries after they naturally lose their charge capacity.

But recycling batteries is likely not going to solve potential demand issues, the study's authors argue. That's because lithium-ion batteries have a long life inside electric cars, and therefore won't be recycled any time soon. "Even increased recycling is not going to solve this problem," Ceder told me.

There are plenty of lithium-ion skeptics who believe the batteries will never be able to offer features consumers need, like hundreds of miles of battery range, the ability to be rechargeable in minutes rather than hours, and a relatively low cost compared to alternatives like natural gas.

For now though, lithium-ion batteries remain one of the most promising innovations we have to create a clean energy future free from fossil fuels, and we should plan for an increase in demand.

"There's essentially no alternative," Ceder said. "If you want to make a big battery today, there's simply no alternative."

China's CATL to supply car batteries to Nissan and Renault